hotel tax calculator illinois

All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. Illinois has a 625 statewide sales tax rate but also.

Illinois Sales Use Tax Guide Avalara

If filing a tax period prior to April 2011 call.

. 6 of 94 of gross receipts. Hotel Operators Occupation Multiple-Site Schedule R-0513 NOTE. This calculator is a tool to estimate how much federal income tax will be withheld.

Average Local State Sales Tax. Amended Hotel Operators Occupation Tax Return N-0513 RHM-7. This is a projection based on information you provide.

If you make 70000 a year living in the region of Illinois USA you will be taxed 11737. The tax is reported on Form RHM-1 Hotel Operators Occupation Tax Return. Illinois Sports Facilities Authority hotel tax.

The calculator will show you the total. FormFiling Payment Requirements. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 782 in Illinois.

An alternative sales tax rate of 9375 applies in the tax region San Jose Hotel Business Improvement District Zone B which. Maximum Possible Sales Tax. Ad Avalara for Hospitality helps your lodging business stay compliant across jurisdictions.

All numbers are rounded in the. Sales Tax Table For Illinois. Hotel Tax Calculator Illinois.

The following local taxes which the department collects may be imposed. Just enter the wages tax withholdings and other information required. Ad Hoteles En Illinois.

Maximum Local Sales Tax. If imposed the preprinted rate on Form RHM-1 will include this tax. Illinois has a 625 statewide sales tax rate but also.

Your average tax rate is 1198 and your marginal tax rate is. 2022 Federal Tax Withholding Calculator. The Hotel Accommodations Tax remains 45.

State hotel tax rate. If imposed the preprinted rate on Form RHM-1 will include. The hotel operators occupation tax in Illinois is as follows.

Hotel Accommodations Tax Return Please use the registration form to register for the Cook County Hotel Accommodations Tax this form can also be used to register for other Cook. 392 cents per gallon of regular gasoline 467 cents per gallon of diesel. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room.

Compara Ofertas de Illinois. Ad Avalara for Hospitality helps your lodging business stay compliant across jurisdictions. 216 average effective rate.

4 Specific sales tax levied on accommodations. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. Hotel tax calculator illinois Sunday June 12 2022 Edit.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Finding hotel tax by state then manually filing is time consuming. Only In Your State.

The tax is reported on Form RHM-1 Hotel Operators Occupation Tax Return. Except as noted on their respective pages the preprinted rate on the return will include any. From august 2019 through january 2022 my average hotel accident settlement was 147500im talking about hotel negligence cases that i handled.

State has no general sales tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The tax is imposed on the occupation of renting leasing or letting rooms to persons for living quarters for periods of less than 30 consecutive days.

Your employer will withhold money from each of. Tu Atajo para Encontrar Ofertas dentro de tu Presupuesto. Reserva con Total Confianza.

Illinois State Sales Tax. KAYAK Buscador de Hoteles. 2 of 98 tax on gross receipts in.

The due date is the same as provided for in. Illinois Income Tax Calculator 2021. Finding hotel tax by state then manually filing is time consuming.

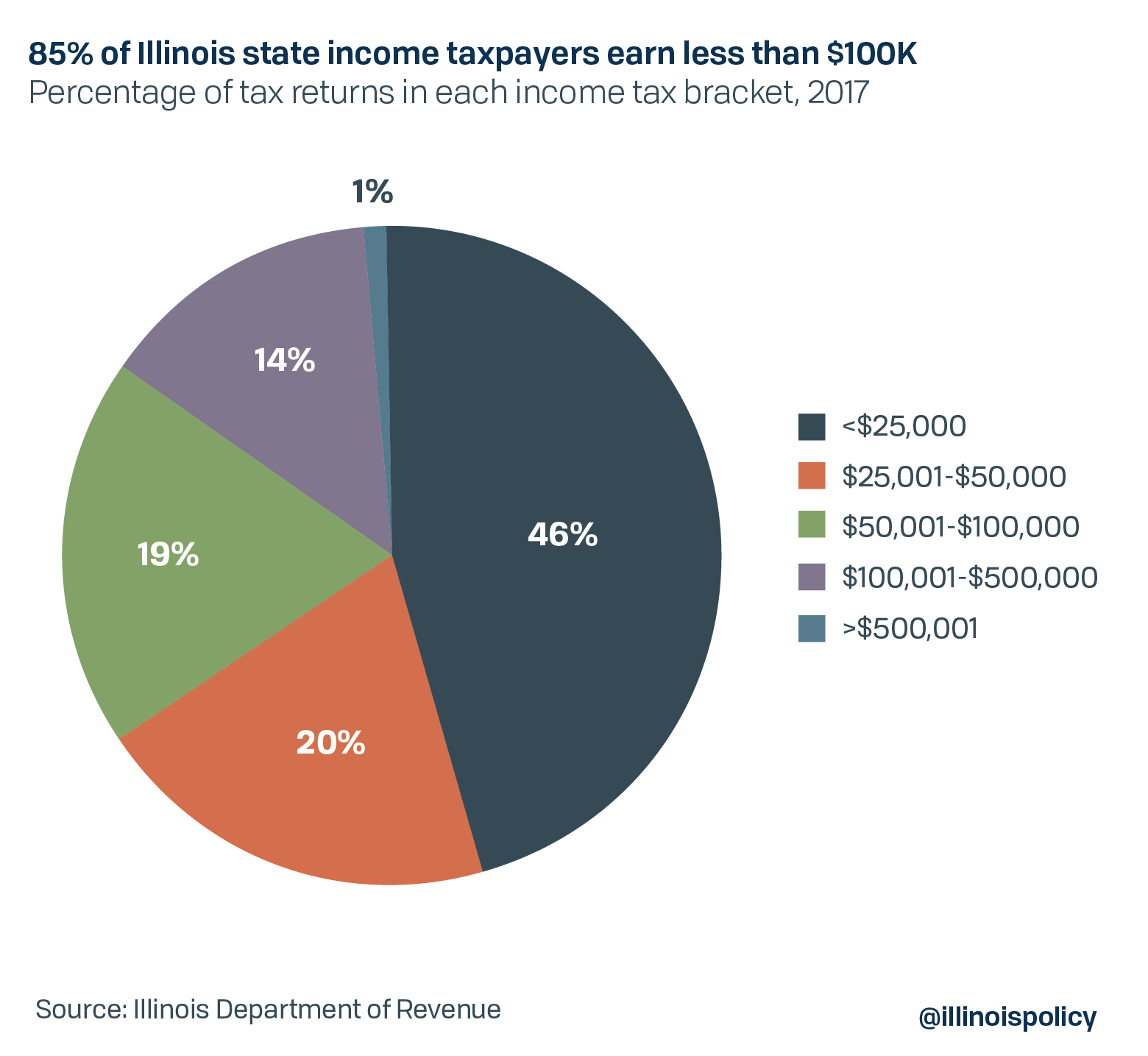

Exemptions And Deductions Give Low Income Illinoisans Less Than Half Tax Rate Of Rich

Il Online Sports Betting Best Sportsbooks Apps In Illinois

Understanding Hotel Taxes Resort Fees Deposits For Incidentals Your Mileage May Vary

How High Are Spirits Taxes In Your State Tax Foundation

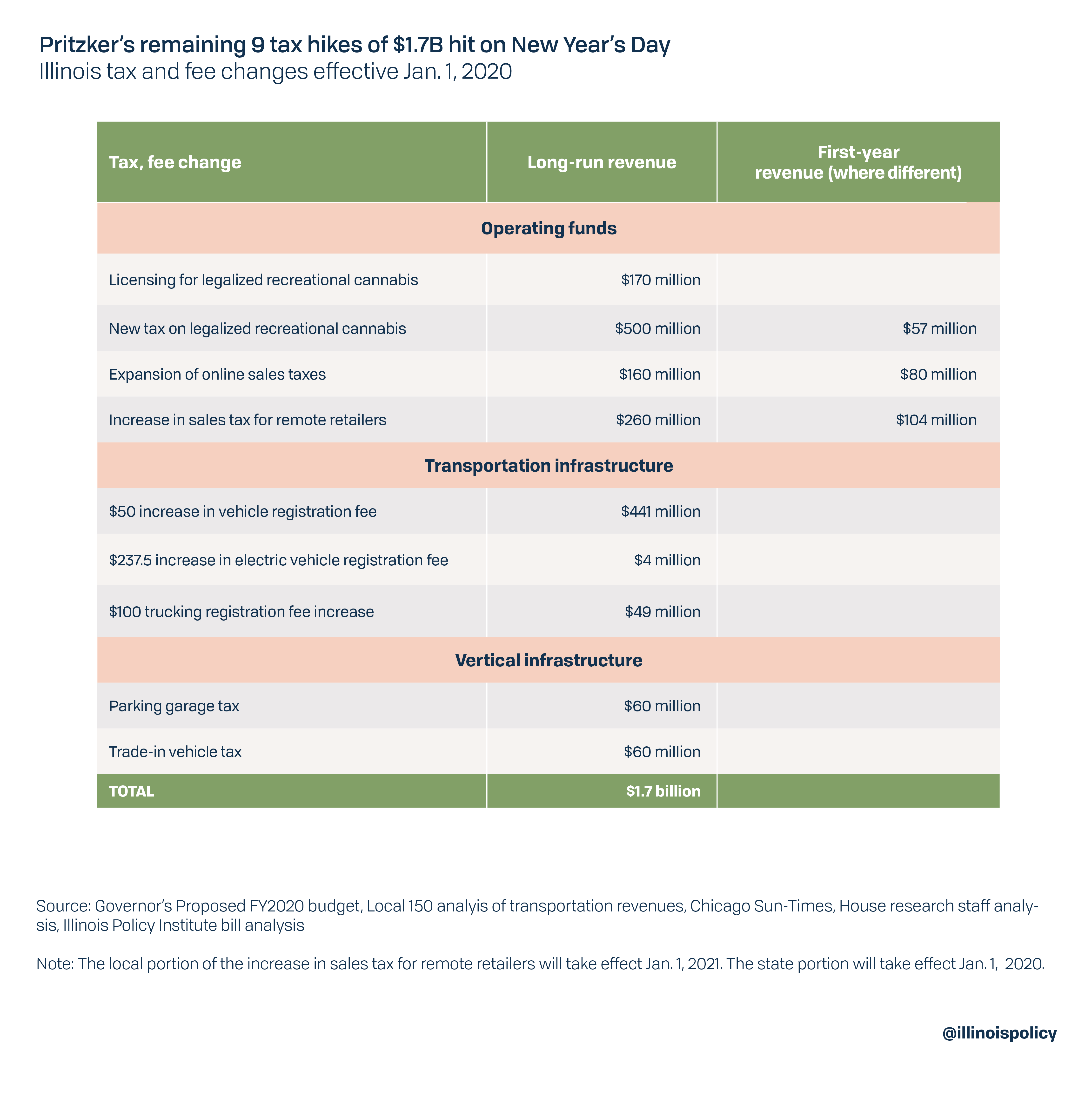

9 New Illinois Taxes Totaling 1 7b Take Effect Jan 1

The Independent Contractor Tax Rate Breaking It Down Benzinga

Illinois Property Tax Calculator Smartasset

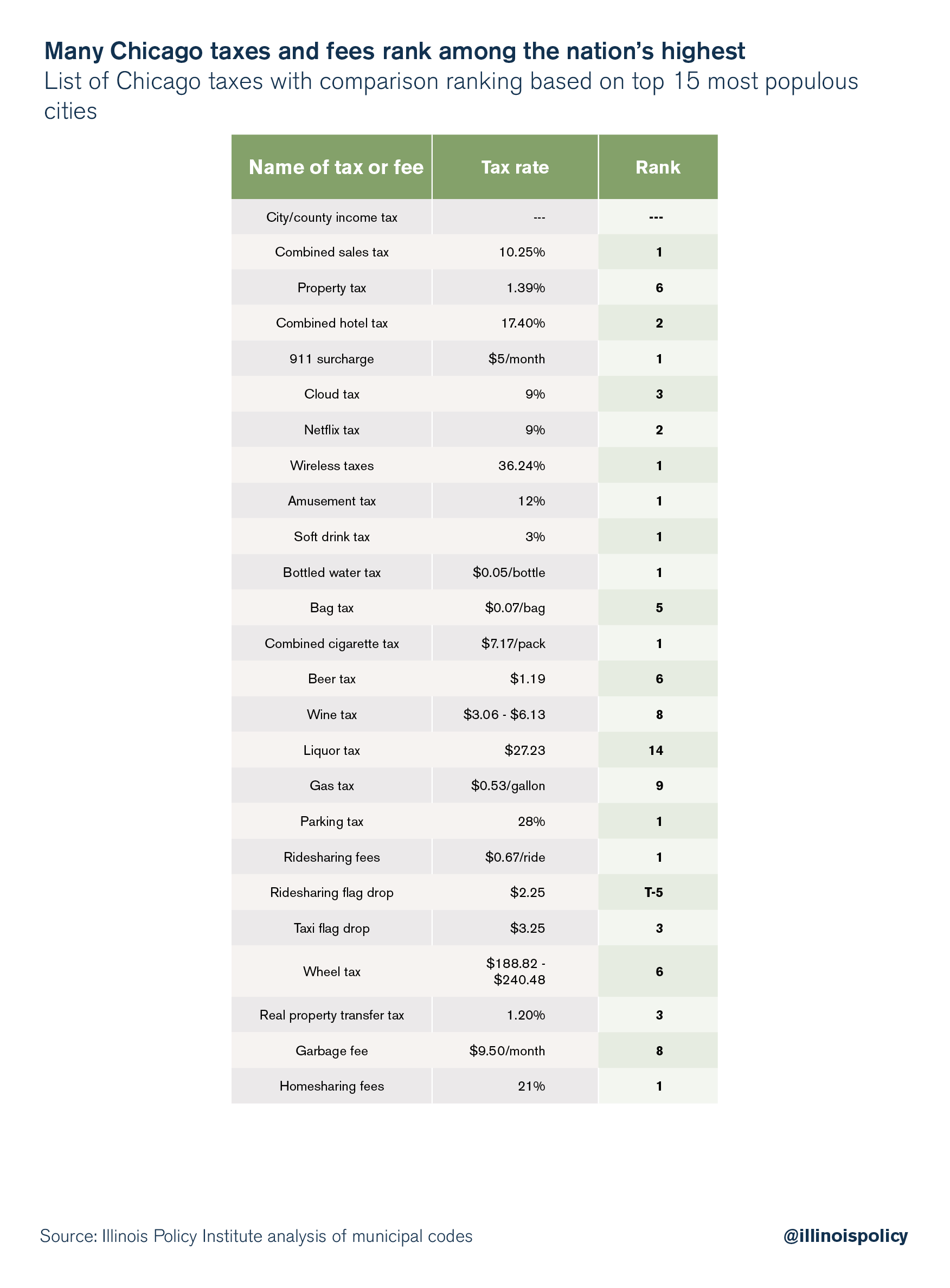

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

States With The Highest Lowest Tax Rates

Sales Tax Calculator And Rate Lookup Tool Avalara

The Deadliest Roads In Illinois Moneygeek Com

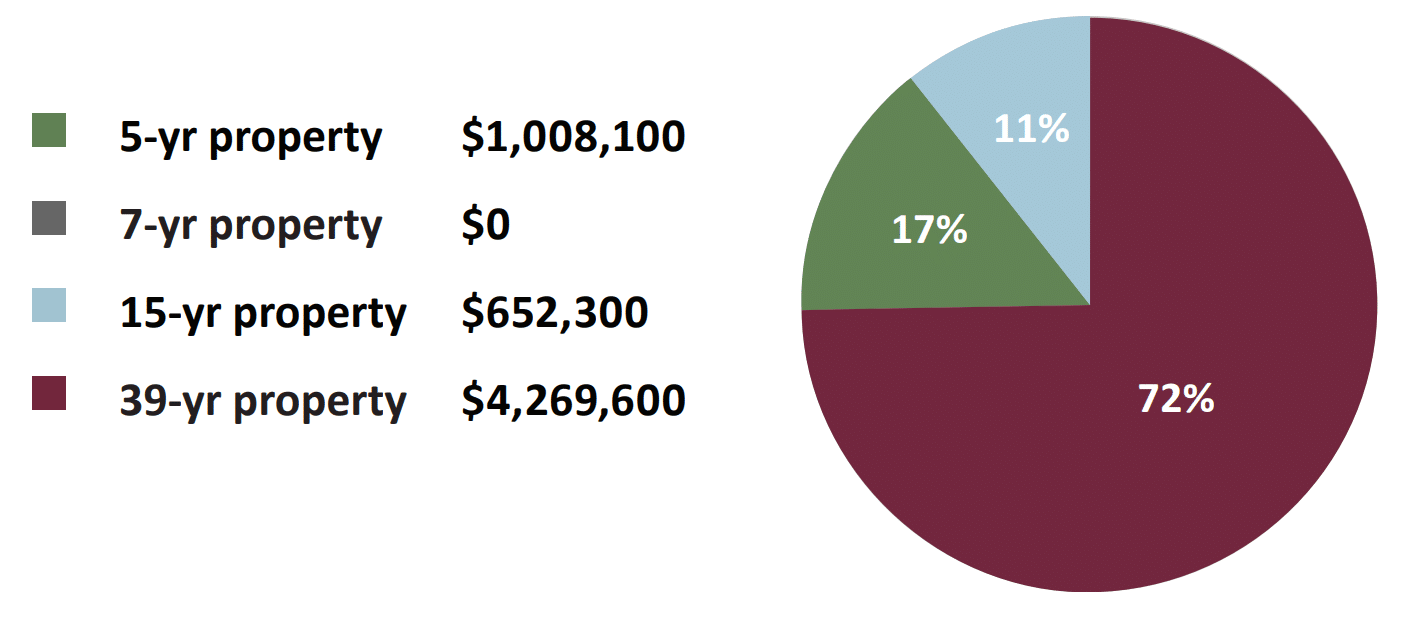

Hotel Cost Segregation Case Study

Illinois Farm Family Business 2019 Budgets Don T Forget Family Living Costs Agfax

Hotel Operators Occupation Tax Excise Utilities Taxes

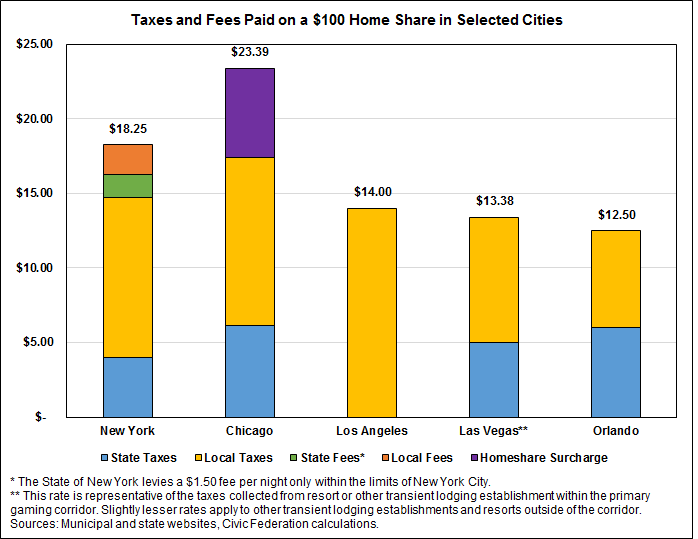

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation